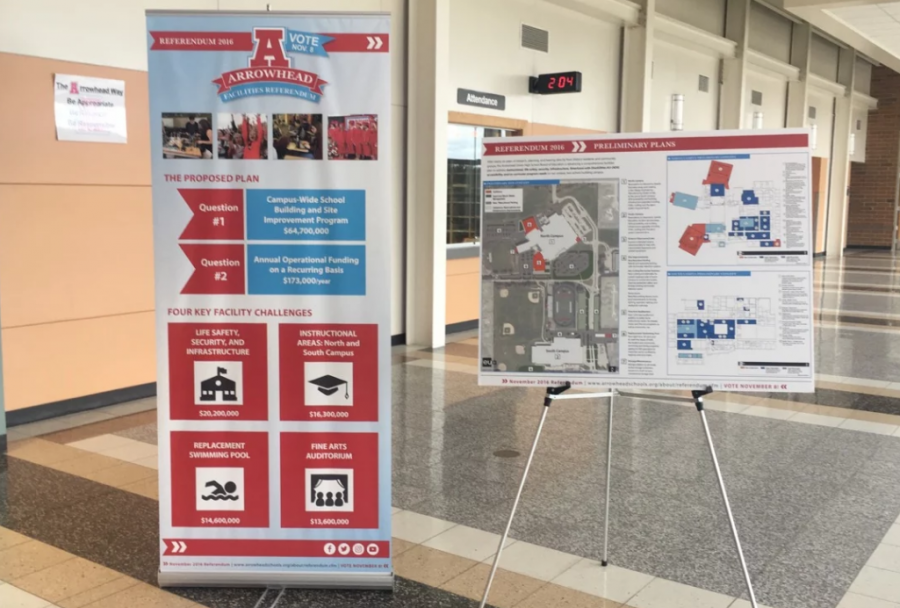

Taxpayers Vote On the Arrowhead 2016 Referendum

On November 8, 2016 all property owners in the Arrowhead Union School District will be asked to vote on the 2016 facilities referendum.

The referendum is asking that property owners in the Arrowhead district, to pay an additional amount on property taxes because “increasing facility needs are too extensive to fund at this rate from the operating budget without directly impacting the funding of instructional programs and services for students.”

The cost of the campus wide school building and site improvement adds up to $64,700,000. This piece of the project suggests that the pool and theater at Arrowhead are “undersized, obsolete, and do not meet the needs of the Arrowhead student population or the community programs that use both facilities.”

The cost of maintaining these improvements is predicted to add up to $173,000 a year.

Taxpayers living in the Arrowhead Union district would see an increase on their property taxes in order to pay for these costs. A property valued at $100,000 would be be required to pay an additional $71 a year in property taxes as a result of the referendum. A property valued at $300,000 would be required to pay an additional $213 a year, and a property valued at $500,000 would be required to pay an additional $355 a year. The overall tax increase is $0.71 for every $1,000 in property value added onto existing property taxes. For a house worth $1 million or more, the referendum would add a minimum of $710 a year onto existing property taxes.

These tax increases are based on a three phase borrowing approach. A three phase borrowing approach includes an intelligence phase, design phase, and choice phase. The intelligence phase is deciding what needs to be done. The design phase is viewing all possible options to execute the decision made in the prior step. Finally, the choice phase is the final decision of how to execute the original decision. Therefore these tax increases are a mere estimate of reality, and it is impossible to be certain as to whether the estimates are an underestimate or an overestimate.

As it pertains to the community of Hartland being asked to fund the renovation of a public sector, I spoke to a representative at a local bank. The fine arts theater renovation alone is predicted to cost over $13 million. To put this dollar amount into perspective consider the following scenario: If a private sector, say a small business in Hartland, were to request a loan of about that size with zero down payment, I asked what the private sector requesting the loan would be required to pay every month for a loan of that size. For a loan of $14 million with a 4% interest rate over a twenty year loan, the recipient of the loan would be required to pay a fee of $84,837 a month for twenty years. For a loan of the same size with a 3% interest rate over a twenty year loan, the recipient of the loan would be required to pay a fee of $77,644 a month for twenty years.

Some who are in favor of the referendum, may bring to light the other largely expensive amenities that Arrowhead has acquired in the past. For example, the Mullet Ice Center. In an article written about the funding of the Mullet Ice Center in 2012, John Wardman the rink manager says, “Our biggest challenge is filling the ice time and making sure we’re in the black every year because we get no tax dollars.” Though the Mullet Ice Center is recognized as the “school hockey rink,” the Mullet Center is treated as a private sector, and does not receive any financial assistance from the government. The Mullet Ice Center is a donated building ran by the Mullet Family and used by the school.

There will be an informational meeting regarding the referendum at Arrowhead High School on November 2, from 6:30-8:00 PM.